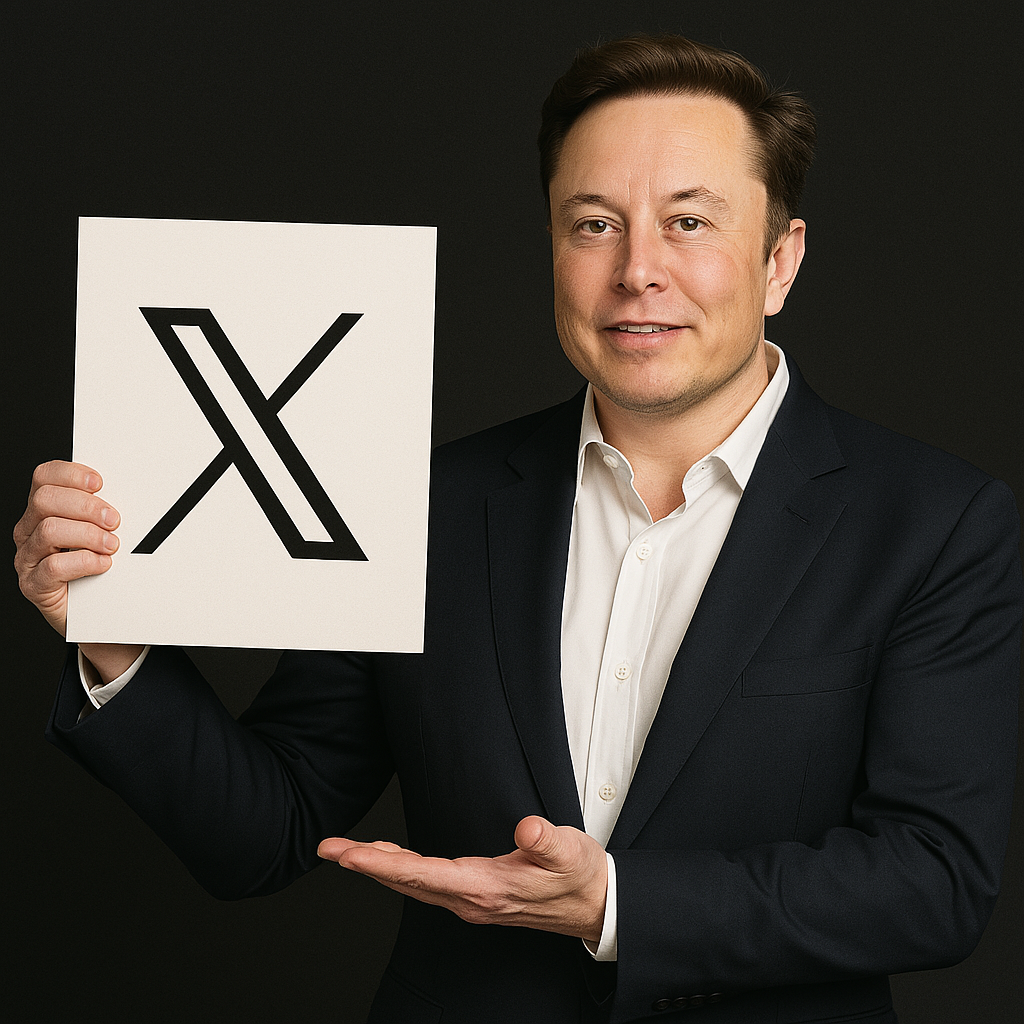

Elon Musk’s artificial intelligence firm xAI has acquired the social media platform X (formerly Twitter) in an all-stock deal valuing the platform at $33 billion. It is a strategic move that officially fuses two of Musk’s most high-profile ventures under a new holding entity, xAI Holdings Corp. The merger combines real-time social data with frontier AI models, while also raising fresh questions about platform stability, moderation, and commercial focus.

For advertisers and marketers, the implications are significant. Not only because of the integration itself, but also because the deal lands just as X shows its first signs of ad revenue growth in over two years.

xAI and X: One Data and Distribution Engine

In announcing the deal, Musk described X and xAI’s futures as “intertwined”, with the merger bringing together data, models, compute, distribution and talent. Practically, this enables xAI’s Grok models to feed on X’s real-time content, bolstering their position against competitors such as OpenAI, Google DeepMind and Anthropic.

The merger transforms X from a standalone social media platform into the engine room of Musk’s broader AI play. The app now serves a dual purpose. It is not just a public square but also a rich training and distribution mechanism for emerging AI products.

This shift reframes X’s commercial value. While advertising will still play a role, the platform’s primary monetisation model may soon be tied more closely to xAI’s tools, contracts and integrations.

Advertising Recovery in Motion

The timing of the deal is not incidental. According to new figures from Emarketer, X is expected to post its first year of advertising revenue growth since Musk’s 2022 acquisition. In 2025, U.S. ad revenue is forecast to increase by 17.5 percent to $1.31 billion, with global ad sales rising 16.5 percent to $2.26 billion.

These figures mark a notable turnaround from recent years. In 2021, before the Musk takeover, X reported $4.5 billion in ad revenue. Following the acquisition, however, the platform saw a sharp decline as advertisers fled over brand safety concerns, mass layoffs and sweeping changes to content moderation.

While X remains well below its pre-acquisition ad levels, the projected growth suggests a degree of stabilisation, particularly among small and medium-sized businesses which had historically been underrepresented on the platform.

Emarketer principal analyst Jasmine Enberg notes that some of this growth may be driven by necessity rather than confidence. “Many advertisers may view spending on X as a cost of doing business in order to mitigate potential legal or financial repercussions,” she said, referencing Musk’s growing influence in Washington as head of the U.S. Department of Government Efficiency (DOGE).

In this context, media spend on X is not just a commercial decision. It is increasingly a political one.

Strategic Leverage in AI and Politics

The merger also strengthens Musk’s hand within the broader AI race. With xAI’s supercomputing capacity now on par with OpenAI, and Grok-3 released in February to compete with leading AI models, the access to live user data via X gives Musk a training advantage that many rivals cannot match.

This data-rich foundation, combined with Musk’s growing political leverage, is likely to position xAI as a leading candidate for future government contracts. If DOGE proceeds with plans for AI-based government reform, xAI is well positioned to become a preferred vendor.

Such contracts could provide both the funding and strategic relevance to support X’s long-term survival, independent of advertising or user growth.

In effect, X’s new role is not just about reach and engagement. It is about data control and infrastructure support for Musk’s AI ambitions.

What It Means for Marketers

The merger comes with several implications for brands and media professionals:

-

Ad Stability Still in Question: While revenue forecasts are improving, X’s long-term advertising strategy remains unclear. It is still not obvious whether brand investment will continue if the platform shifts more focus toward AI development over user experience or content moderation.

-

Less Transparency: As a private company, X no longer discloses financial performance. With AI now at the core of its commercial offering, marketers should not expect detailed reporting on ad effectiveness or user growth.

-

Limited Brand Safety Guarantees: Moderation remains light-touch on the platform. If X becomes less reliant on advertiser funding, there may be less incentive to maintain safeguards that protect brand equity.

-

AI Access and Partnerships: xAI is expected to launch more tools that lean heavily on X’s live social data. There may be short-term opportunities here for marketers, but also reputational risks.

-

New Commercial Dynamics: As smaller businesses return to X, and with Musk aligned closely with the U.S. government, ad strategy is now influenced by political as well as commercial factors.

The merger of xAI and X is not a conventional corporate deal. It is a consolidation of influence, data and AI infrastructure under a single leadership vision. X is no longer just a media platform. It is now a critical input in a broader AI ecosystem that could eventually serve commercial and government clients alike.

For marketers, the near-term message is mixed. Ad revenues are recovering, but the platform’s long-term direction is becoming harder to predict. A cautious, test-and-learn approach remains essential.

RECOMMENDED FOR YOU

OpenAI Begins Testing Ads Inside ChatGPT

For the past two years, marketers have treated ChatGPT…

For the past two years, marketers have treated ChatGPT…

Google Rebuilds Checkout For AI Shopping

Agentic shopping has moved from theory to reality, and…

Agentic shopping has moved from theory to reality, and…

LinkedIn Reveals Jobs On The Rise 2026

LinkedIn has released its latest Jobs on the Rise…

LinkedIn has released its latest Jobs on the Rise…